Heloc loan estimate

How much can you borrow. A higher DTI debt-to-income level may be allowed.

Home Equity Calculator Best Sale 54 Off Sportsregras Com

The draw period is the phase.

. A home equity line of credit or HELOC is a special type of home equity loan. If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40. Depending on your financial goals a home equity loan might be a better fit.

Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. Reduced down payments even as low as 35.

Include the rate of interest any additional equity you would like to withdraw as a cash payment the closing costs associated with the loan and the length of the loan term. Federally-insured program with specific advisors and resources. If you want to have the flexibility to tap into your home equity multiple times on an ongoing basis for recurring needs then a HELOC.

A HELOC is not an ATM. FICO Score 720 80. Find access to local lenders check rates in one place and get expert tips and advice.

Compare the latest rates loans payments and fees for heloc and home equity loans. An FHA construction loan will have a few more stipulations as well such as land ownership involved in the. Variable - AK.

Payment calculator applies only to the. Groceries clothes vacations etc. The APR will vary with Prime Rate the index as published in the Wall Street Journal.

Because a HELOC behaves a lot like a credit card in that you can draw from it as needed its tempting to use it for whatever you need. At Bank of America we want to help you understand how you might put a HELOC to work for you. A home equity loan make sure you understand the total package of fees that you would have to pay.

When you get a HELOC through Prosper your mortgage and HELOC combined can be. If you are applying for a HELOC a manufactured housing loan that is not secured by real estate or a loan through certain types of homebuyer assistance programs you will not receive a GFE or a. The amount you qualify for is based upon the amount of equity available in your home.

A HELOC is a line of credit borrowed against the available equity of your home. Loan type rate type loan term down payment amount loan amount points and credits. If your lender will lend you 80 of your equity youll be able to borrow.

If however you only owed 200000 on your mortgage you would have 100000 or 33 in equity and most likely. The lenders should provide you. This is the amount you want to borrow.

CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value. Loan length in months. Key benefits of this loan compared to one you would secure at a bank include.

Before you decide on a HELOC vs. A boat loan can help you finance the cost of a boat which typically ranges between 20000 to 75000 depending on the type of boat. By extending the loan term you may pay more in interest over the life of the loan.

Its like having a credit card secured by your home equity. HELOC Payments How are HELOC repayments structured. All fields are required.

Ask for a loan estimate from each and provide the same details to each lender. If you estimate your homes value at 300000 and you have a mortgage loan for 200000 you have 100000 in equity. The payment reduction may come from a lower interest rate a longer loan term or a combination of both.

HELOC Important Terms. FICO Score 680 80. To understand how much boat you can afford youll need to.

For those loans you will receive two forms a Good Faith Estimate GFE and an initial Truth-in-Lending disclosure instead of a Loan Estimate. As noted above a HELOC is an adjustable-rate loan and a fixed-rate loan might be a safer alternative if youre holding that loan longer-term. Rather than borrowing a specific sum of money and repaying it a HELOC gives you a line of credit that lets you borrow money as needed up to a certain limit and repay it over time.

Enter your loan term. Home Equity Line of Credit The Annual Percentage Rate APR is variable and is based upon an index plus a margin. In that case you most likely wouldnt qualify for a home equity loan or HELOC.

This is the annual interest rate youll pay on the loan. The results will compare your new home equity loan payments to the monthly cost of the old debts the effective interest rate and the total monthly payment on those debts. A home equity line of credit or HELOC could help you achieve your life priorities.

Home equity loans typically range from 5 to 15 years. Let Zillow help you finance your next home. A HELOC home equity loan will give you the most favorable monthly payment terms due to the length of the loan available.

15000 to 750000 up to 1 million for properties in California. Loan 1 Loan 2 Loan 3. A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home.

While a HELOC offers the most favorable terms typically they take the longest for approval. To qualify for a HELOC you need to meet the requirements set by the lender. Consolidating multiple debts means you will have a single payment monthly but it may not reduce or pay your debt off sooner.

As of July 28 2022 An early closure fee of 1 of the original line amount maximum 500 will apply if the line is paid off and closed within the first 30 months. If youre not sure how much youre eligible for use our home equity loan and HELOC amount calculator first. Enter your loan amount.

The HELOC repayment is structured in two phases. Enter your loans interest rate. Upwards of 30 -45 days.

These numbers can also affect the interest rate they might offer you on a HELOC. Lenders typically look at your home equity your loan-to-value ratio your debt-to-income ratio and your credit score before they decide whether you qualify for a home equity line of credit. How it works.

Home Equity Loans Selco

Home Equity Line Of Credit Qualification Calculator

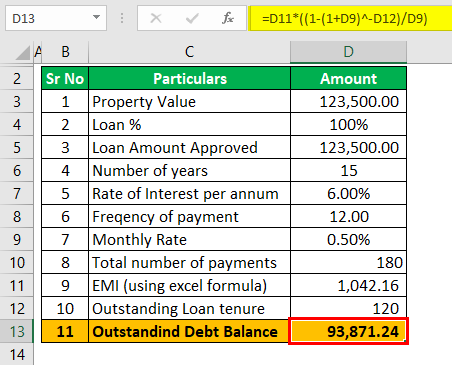

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Mortgage Calculator

The Difference Between A Home Equity Loan And A Home Equity Line Of Credit Palisades Credit Union

Home Equity Calculator Free Home Equity Loan Calculator For Excel

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

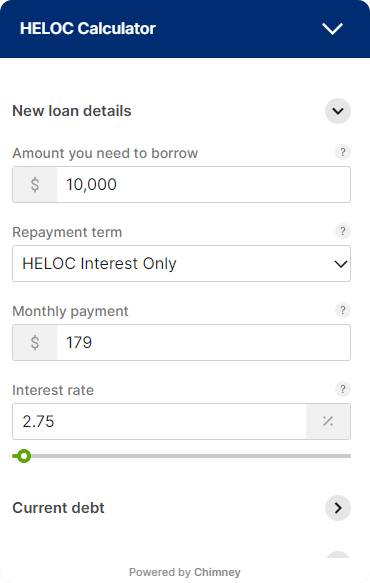

Heloc Calculator

Looking For A Heloc Calculator

Heloc Payment Calculator With Interest Only And Pi Calculations

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

Mortgage Payoff Calculator With Line Of Credit