Mo payroll calculator

Currently there are three tax brackets in Kansas that depend on your income level. Missouri Missouri Hourly Paycheck Calculator Results Below are your Missouri salary paycheck results.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Discover ADP Payroll Benefits Insurance Time Talent HR More.

. Missouri Paycheck Calculator Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The results are broken up into three sections. Additions to Tax and Interest Calculator Income Tax.

Free Unbiased Reviews Top Picks. This free easy to use payroll calculator will calculate your take home pay. Ad Compare This Years Top 5 Free Payroll Software.

Paycheck Results is your gross pay and. Ad Compare This Years Top 5 Free Payroll Software. GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software.

Your manual payroll calculations are based on the pay frequency and their hourly wage. Just enter the wages tax withholdings and. Get Started With ADP Payroll.

Follow the steps on our Federal paycheck calculator to work out your income tax in Missouri. Free Unbiased Reviews Top Picks. Withholding Calculator The Missouri Department of Revenue Online Withholding Tax Calculator is provided as a service for employees employers and tax professionals.

All Services Backed by Tax Guarantee. Ad Process Payroll Faster Easier With ADP Payroll. Supports hourly salary income and multiple pay frequencies.

So for someone who is full-time making 11 an hour on a biweekly pay schedule the calculation. Missouri Salary Paycheck Calculator Change state Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes.

Missouri Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Enter your salary or wages then choose the frequency at which you are paid. Ad Get the Payroll Tools your competitors are already using - Start Now.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Rules for calculating payroll taxes Old Tax Regime Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions. Ad Process Payroll Faster Easier With ADP Payroll.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Missouri. Well do the math for youall you need to do is enter. Below are your Missouri salary paycheck results.

Figure out your filing status work out your adjusted gross income Total annual. If youre single married and filing separately or a head of a household you. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Instead you fill out Steps 2 3 and. Ad Payroll So Easy You Can Set It Up Run It Yourself. Free Federal and Missouri Paycheck Withholding Calculator.

Get Started With ADP Payroll. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15.

The results are broken up into three sections. Simply enter their federal and state W-4 information as. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Missouri.

The state income tax rate in Missouri is progressive and ranges from 0 to 53 while federal income tax rates range from 10 to 37 depending on your income. Its a progressive income tax meaning the more. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

Discover ADP Payroll Benefits Insurance Time Talent HR More. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the.

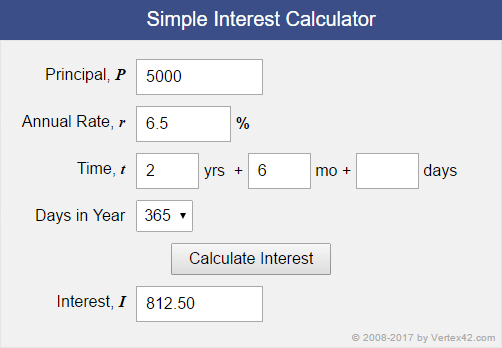

Simple Interest Calculator And Formula I Prt

Missouri Income Tax Rate And Brackets H R Block

Payroll Tax Calculator For Employers Gusto

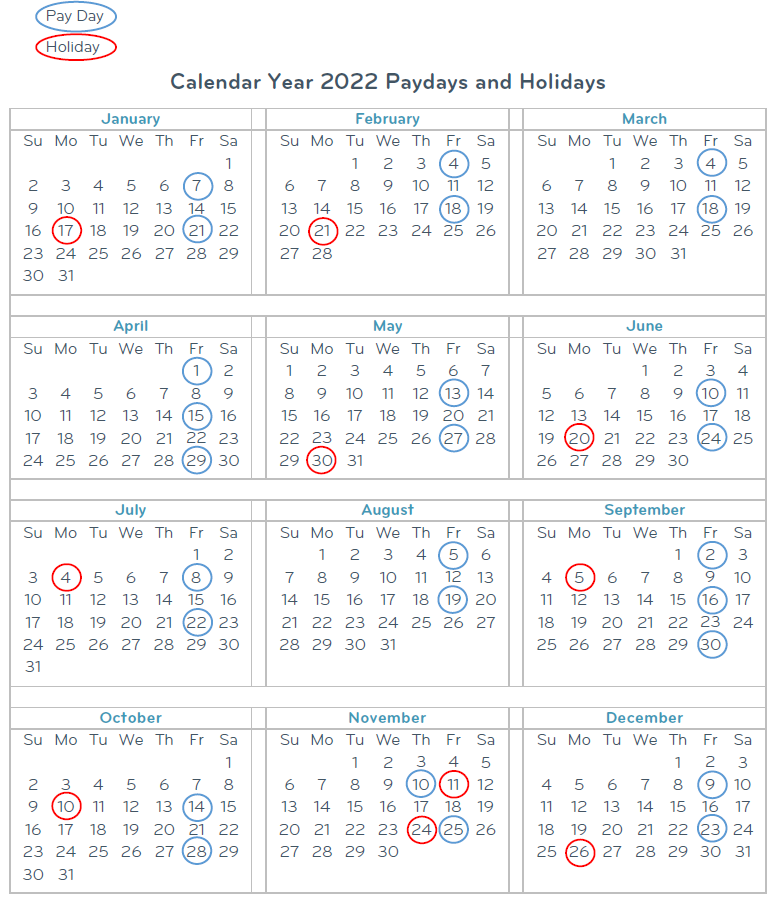

Payroll Calendar 2022 Paydays And Holidays

Missouri Paycheck Calculator Smartasset

Missouri Paycheck Calculator Smartasset

Remote Work Resources

Llc Tax Calculator Definitive Small Business Tax Estimator

Missouri Hourly Paycheck Calculator Paycheckcity

Self Employment Ledger Forms Beautiful Printable Payroll Ledger Payroll Payroll Template Bookkeeping Templates

Tip Tax Calculator Primepay

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Calculate Your Real Debt And The Quickest Least Expensive Way To Pay It Off

Calculating Payroll For Employees Everything Employers Need To Know

Prevailing Wage Missouri Labor

Hourly Paycheck Calculator Calculate Hourly Pay Adp

How To Calculate Cannabis Taxes At Your Dispensary