56+ can you deduct mortgage interest on investment property

Web Interest is a significant long term expense so its reassuring that it will be balanced out with tax deductions. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Can You Deduct Mortgage Interest On A Rental Property Youtube

Web You can deduct the costs of certain materials supplies repairs and maintenance that you make to your rental property to keep your property in good.

. If the cash-out money was used for some personal purchase vacation new car pay off credi cards etc or just put in the bank to collect interest then the loan interest. Web Yes you can take the mortgage interest deduction on up to two properties at once. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Owning an investment property offers many tax advantages. You cannot take the mortgage. Starting in 2019 you can only.

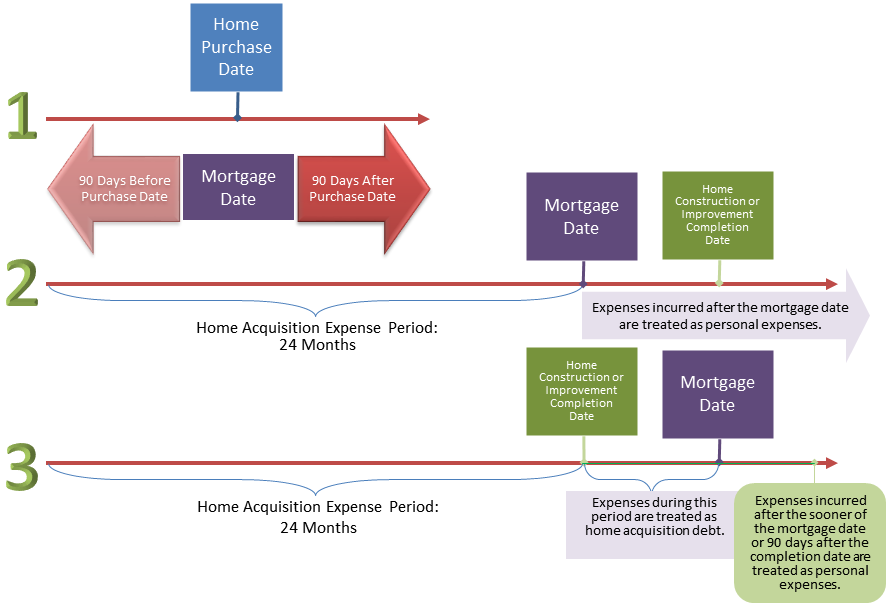

Web If the cash-out money was used to improve your primary residence then the interest would be a Schedule A deduction for home mortgage interest but only if you itemize. Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home. Homeowners who bought houses before.

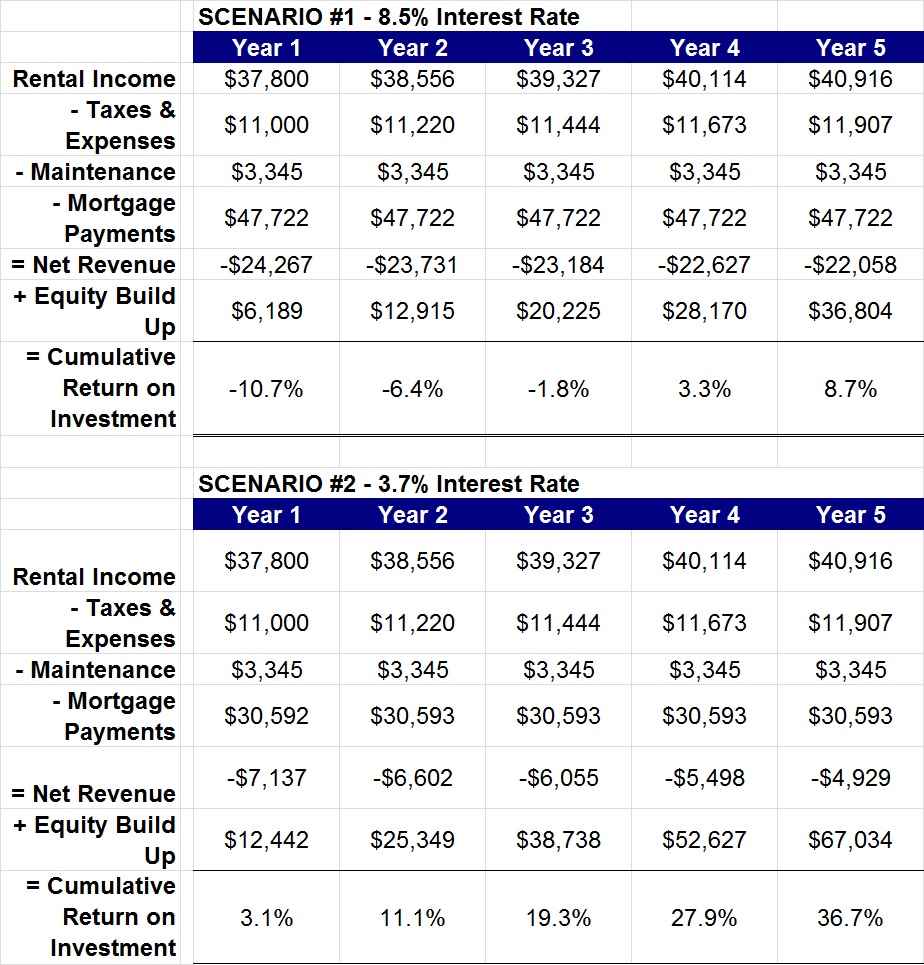

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Lets take a look at an example. Learn about some tax deductions that you may not have been aware of to maximize your profits.

Web Up to 25 cash back The 5000 payment which is almost all for interest charges is not a deductible interest payment. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. They must be a residential property however.

Web No you can not deduct the interest on a HELOC if the proceeds were used to payoff the mortgage on an investment property. If you took out a 25. Six months later Phil pays back the 5000 loan with interest.

What Is Mortgage Interest Deduction Zillow

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Is Your Mortgage Considered An Expense For Rental Property

.jpg)

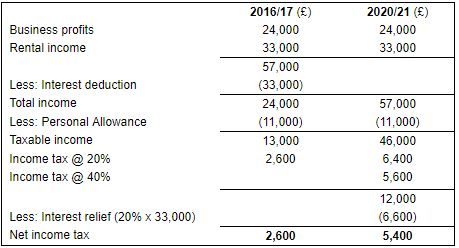

Landlord Tax Changes Under Section 24 Sandersons

Buy To Let Tax Relief Moneysupermarket

Is Your Mortgage Considered An Expense For Rental Property

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

Is Interest Paid On Investment Property Tax Deductible

Buy To Let Mortgage Interest Tax Relief Explained Which

Unemployment Public Policy And The Changing Labour Market

The Hidden Value In Rental Properties When Rates Are Low Dave The Mortgage Broker

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Buy To Let Tax Calculator Mortgages For Business

How To Invest 50k The 8 Best Investing Strategies The Dough Roller

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Relief Restriction Mercer Hole

Tenants To Let Renting Glossary Of Terms Sandersons